8915-e tax form release date

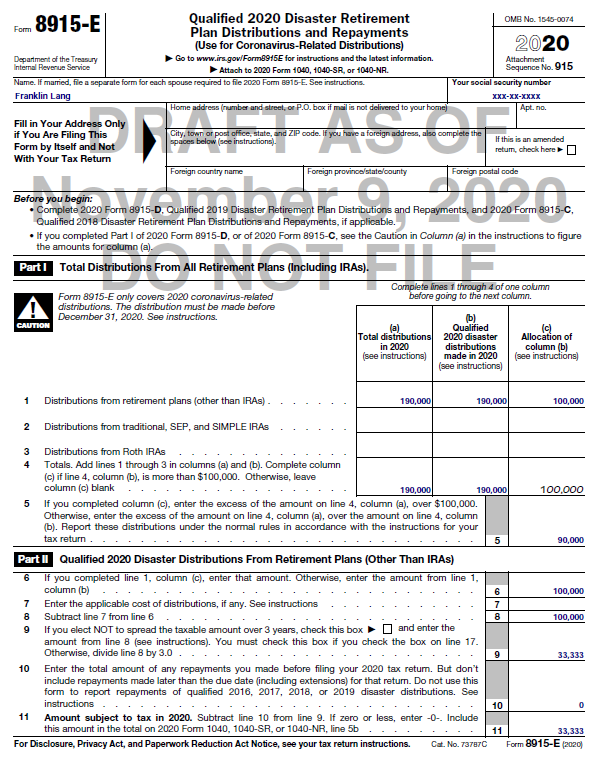

Select either a federal or state return. Use Form 8915-E if you were adversely affected by a qualified 2020 disaster or impacted by the coronavirus and you received a distribution that qualifies for favorable tax.

National Association Of Tax Professionals Blog

If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions.

. I predict we will see 8915-F on. The 8915-C 8915-D and 8915-E are projected to be available on release 2020-31 202003010 scheduled for March 21 2021. Recently many people have found their lives upside down out of work working less furloughed or.

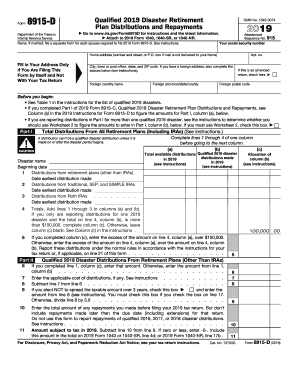

Follow these steps to find a forms release date in ProSeries. 9 rows Instructions for Form 8915-D Qualified 2019 Disaster Retirement Plan Distributions. The remaining 55 of the distribution is taxable on your 2021 and 2022 tax returns 21 23 on your 2021 tax return and 33 13 on your 2022 tax return.

Press the F6 to bring up the Open Forms window. Examine Form 8915-E to see the. The 8915-F is scheduled for release on 33122.

Officially the release date is March 31st. April 08 2021. Do not use a Form 8915-F to report qualified 2020 disaster distributions made in.

Made or received in 2020. Form 8915-E for retirement plans. This form replaces Form 8915-E for tax years beginning after 2020.

Form 8915-F is now available in ProSeries 2021 and should be e-file ready on 03242022. Open a client file. If you do not yet see the form go to the Update menu and choose Update Installed.

The 8915-E is available in the TY20 program only.

Solved Form 8915 E Is Available Today From Irs When Will The Program Make It Available For Me To File Page 2

Form 8915 E Partial Repayment Results In 0 Crd Tax Liability For 2020 R Tax

Tax Information Center Irs H R Block

Publication 4492 A 7 2008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

/cloudfront-us-east-1.images.arcpublishing.com/gray/KDHKYBCCWRFJPH5RTB2YD3VCKU.png)

Covid 19 S Impact On 2020 Tax Returns

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

When Will Form 8915 E 2020 Be Available In Turbo Tax Page 19

Diaster Related Early Distributions Via Form 8915

Irs Warns Of Delays And Challenging 2021 Tax Season 10 Tax Tips For Filing Your 2020 Tax Return

Retirement Tax Services Form 8915 E If Your Clients Had 2020 Taxable Distributions Learn Asap Meta Http Equiv Content Security Policy Content Script Src None

Publication 4492 A 7 2008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

Disaster Assistance And Emergency Relief For Individuals And Businesses Internal Revenue Service

Irs Extends Interim Amendment Deadline For Pre Approved Plans

Irsnews On Twitter Irs Urges You To Ask Your Tax Preparer To E File Your Return This Will Prevent Delays In Processing Learn More At Https T Co Ztn0q2f6ck Https T Co Ieonpeui8f Twitter

What Clients Won T See On This Year S 1099 R Form Investmentnews

Reminder Due Dates For 2020 Tax Returns And The Change Of Tax Day To May 17th Wegner Cpas

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

When Will Form 8915 E 2020 Be Available In Turbo Tax Page 19

8915 D Form Fill Out And Sign Printable Pdf Template Signnow